How Tint helps Turo empower hosts and unlock growth with compliant and tailored off-trip insurance

Turo Company Details:

Headquarters: San Francisco, CA

Company Size: ~750

Industry: Mobility

The Big Challenge:

Turo hosts face a complex insurance dilemma. Personal auto policies aren’t designed for business use, and traditional commercial policies are often cost-prohibitive or misaligned with the way hosts use their vehicles. As hosts grow the number of vehicles on Turo’s platform, many find themselves out of options—and out of compliance.

The Embedded Advantage:

An embedded off-trip insurance solution that leverages Turo’s platform data to create a streamlined user-experience and highly relevant insurance. This embedded approach unlocks savings, simplicity, and peace of mind for hosts. For Turo, this resulted in significantly improved host satisfaction.

When Turo set out to find a partner that could offer embedded insurance, they aimed high, seeking a custom-built solution that could meet the nuanced needs of their growing host base. Within the first year, the program delivered impressive results: industry-leading loss ratios, industry-leading premium growth, and multiple enhancements driven directly by host feedback.

As the leading car-sharing platform trusted by tens of thousands of hosts across the U.S., Turo knew a one-size-fits-all solution wouldn’t cut it. Finding affordable, tailored insurance is a constant challenge for hosts nationwide. To solve it, Turo looked for a partner who combined deep expertise in embedded insurance with the ability to move fast and remain compliant.

Turo’s business development and insurance teams turned to Tint to develop an innovative insurance model tailored to the needs of professional Turo hosts.

Why Off-Trip Insurance Makes Sense for Hosts

Turo hosts with multiple vehicles operate like businesses. When it comes to insurance, they are often stuck between a rock and a hard place.

Personal policies, designed for the average consumer, can quickly become limiting for a growing host on Turo. Commercial fleet policies can be far more cost-intensive and include coverages that don’t make sense for their Turo business.

Tint’s off-trip insurance makes it possible for professional hosts to:

- Operate compliantly with intuitive coverage designed for them

- Secure significant annual savings with an average of $951 per vehicle per year compared to personal insurance*

- Receive support from experts who understand their business and insurance concerns

*Estimated annual savings are calculated by comparing average costs of personal insurance according to Bankrate as of July 1, 2025 against premiums paid by Turo hosts for off-trip insurance, powered by Tint, from July 1, 2025.

Beyond that, hosts gained peace of mind. With a program aligned with their business needs and goals, they no longer had to worry about unknowingly violating underwriting rules or being denied coverage.

Iterating Quickly to Capture Product-Market Fit

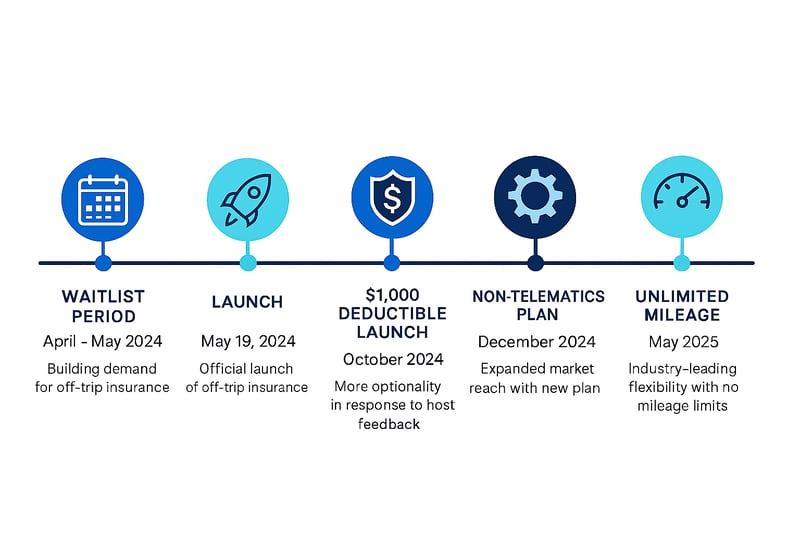

Many embedded programs stall post-launch. With transparent communication between Tint, Turo, and hosts, the off-trip insurance program has seen several key enhancements to support program growth and market fit.

- Introduction of more deductible options

- Fast implementation of telematics and non-telematics plan options

- Includes a growing list of 10+ approved telematics providers

- Removal of mileage restrictions

“Unique product development, fast iterations to meet consumer needs, and better pricing are all the hallmarks of a good embedded insurance program. Our work with Turo exemplifies that.”

Matheus Riolfi|Co-founder & CEO, Tint

Growth Driven By Embedded Innovation

The collaboration between Tint and Turo created a ripple effect across the Turo ecosystem. Lower insurance costs empowered hosts to add more vehicles to the Turo platform. Easier onboarding drove Turo’s platform supply. Better coverage reduced risk for both Turo and its users.

Finding the Right Partner For You - And Your Customers

Initially, Tint stood out for the level of customization. While plug-and-play embedded insurance is compelling for many, the Turo team wanted a step beyond that. They wanted a program that was custom-tailored to the needs of their hosts, and Tint was able to deliver.

Start with a bold vision. Trust your partner to execute against it, but make sure they’re willing to build on user feedback. Tint did this for us, and it resulted in a great program with clear product-market fit.

Kimaya Cole, Strategic Partnerships, Turo

After the initial excitement, Tint’s shared vision and cross-functional investment across legal, marketing, data, claims, and more has given the Turo team continued confidence in the ability to grow the program in the future.“Tint isn’t a one-size-fits-all partner. Their willingness to invest across functions has helped us improve host satisfaction and drive revenue growth, while reducing our hosts' insurance-related pain points," says Cole.

“This collaboration with Tint has amplified our lender network and is helping hosts grow their total number of vehicles on the platform. Insurance savings create a flywheel effect, supporting supply growth while reducing risk.”

Eric Hoelzen|Head of Insurance, Turo

Looking Ahead

With strong early results and clear product-market fit, the teams at Tint and Turo are already exploring new ways to expand and evolve the program. Growth will continue to be guided by one principle: build for the host.