The Era of Embedded Protection

The world is witnessing a profound shift in how companies approach protection solutions, and embedded insurance and protection are at the forefront of this transformation. For businesses, considering adding embedded customer protection to their platforms, the time has never been more opportune.

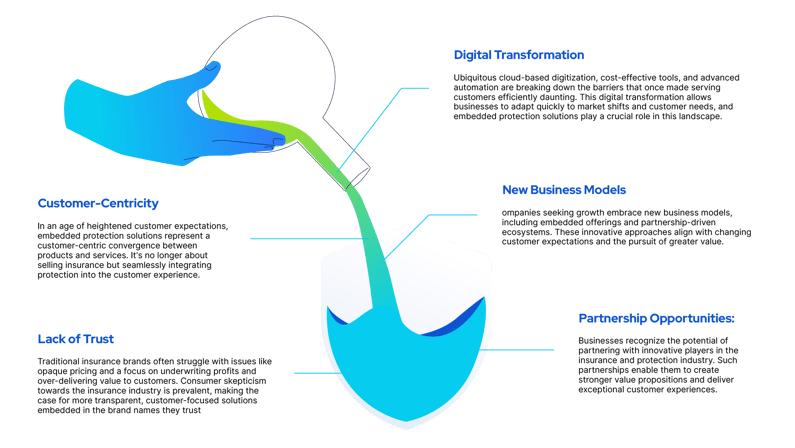

Why Embedded Protection, Why Now?

Before diving into the advantages of embedded protection solutions, let's explore why this paradigm shift is happening and why it's essential for businesses today. Several key factors are driving the rise of embedded insurance:

Embedded Protection: A Shift from Tradition

Historically, traditional insurers have relied on joint ventures and partnerships to distribute their products. However, these arrangements have often fallen short due to undifferentiated features, and overall distribution. Businesses are now seeking alternatives that align better with their goals, including higher customer trust and loyalty.

Embedded protection solutions empower businesses to take control of their products, risks, and overall customer experience. By partnering with innovative protection experts, companies can offer superior value propositions, reduce the cost of their protection programming, and enhance pricing accuracy.

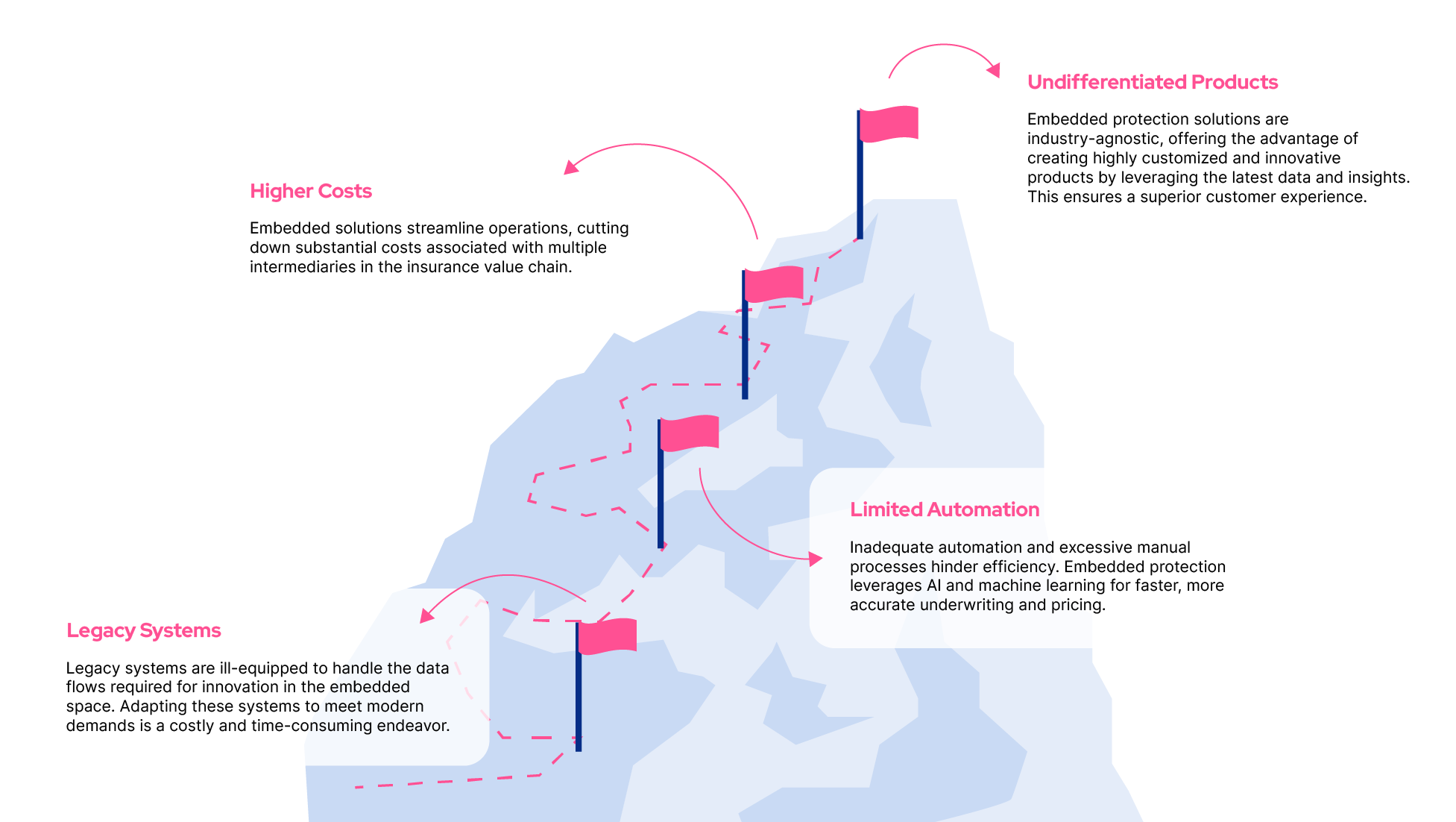

Challenges to Overcome

While the benefits of embedded protection solutions are clear, there are challenges that businesses must address:

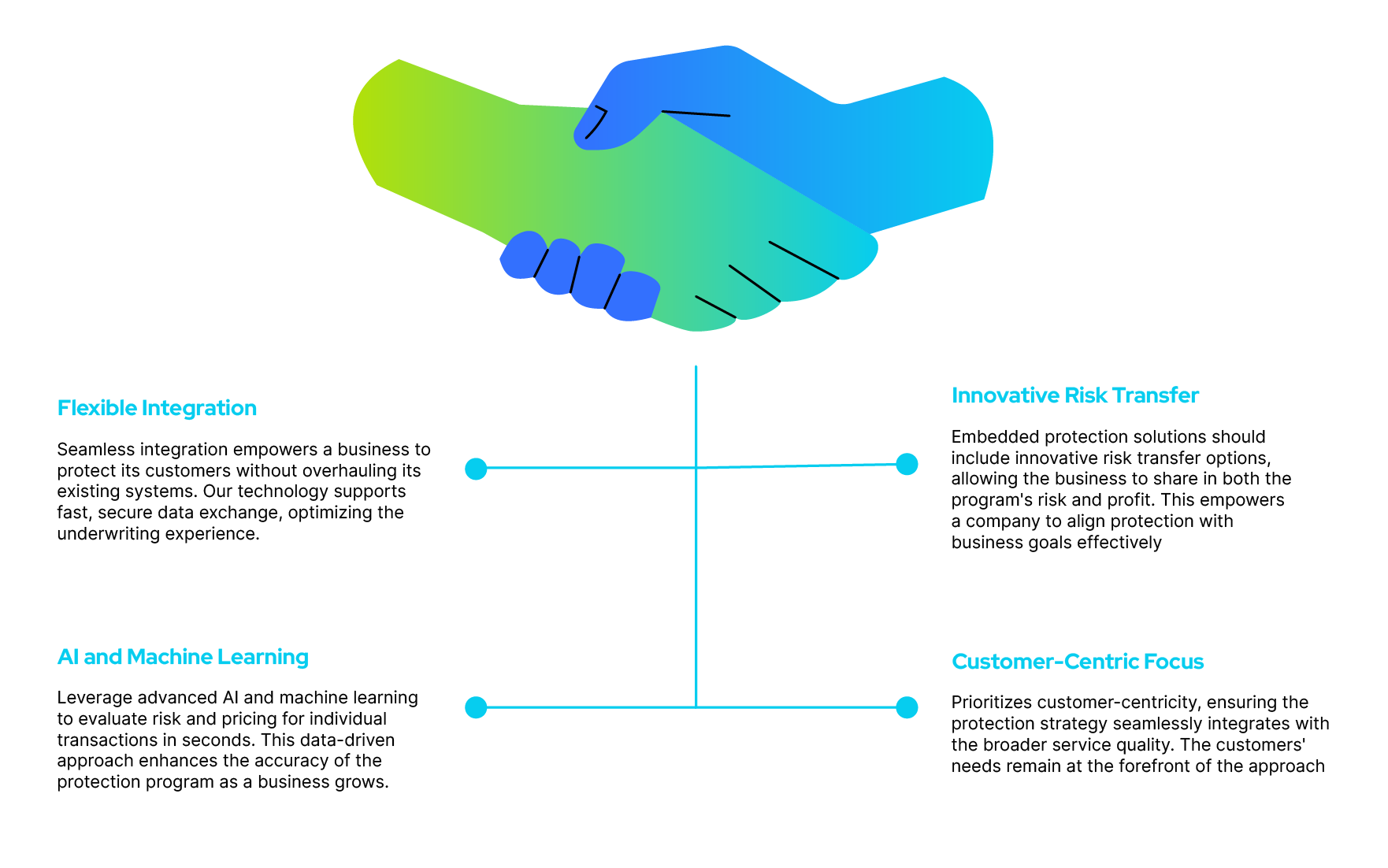

Why Partner?

Why Partner?

A good partner understands the challenges businesses face in adopting embedded protection solutions. Here's what to look for in a stand-out protection partner:

Industries Ready to Embrace Embedded Protection

Embedded protection solutions are not limited to a specific industry; they span various sectors and companies. Industries that already see the appeal of embedded insurance and protection include:

- Original Equipment Manufacturers (OEMs)

- Equipment Rental Marketplaces

- Freight Brokers, 3PLs, 4PLs

- Health Care and Pharmaceuticals

- Real Estate

- Financial Services

- Travel and Hospitality

- Retail

- Cyber Solutions

For instance, certain travel companies consider embedded protection part of a broader network of services, transforming how consumers interact with their products.

The Imperatives for Success in the Era of Embedded Protection

As embedded insurance and protection gains prominence, businesses must embrace strategic imperatives to thrive in this evolving landscape:

Unlocking Sustainable Success

In a world where customer needs and expectations are rapidly changing, embracing embedded protection solutions is not just a strategic choice; it's a necessity. Tint guides you on this transformative journey, offering you the tools, technology, and expertise to unlock sustainable success.

Are you interested in elevating your protection services and offering customers a sense of security? Get in touch with the protection experts at Tint today, and let's work together towards a successful and brighter future for your business.