Analysis paralysis. You’ve likely heard of it before, but it isn’t just a buzzword. It's a cognitive phenomenon that occurs when individuals are overwhelmed by an abundance of information or choices, rendering them unable to make decisions confidently and effectively.

In business, this indecision can have a significant impact on the balance between maximizing profitability and ensuring safe, pleasant experiences for end-users. When you already have a protection solution in place it’s easy to say, “Why rock the boat?”. It’s natural to hesitate or to avoid change. But what about when your hesitation means leaving stacks of cash on the table? So, let's delve into the real repercussions of analysis paralysis when it comes to your protection solution and how to break the cycle.

How to Make More Money: Transforming Protection into a Profit Center

Protecting your business from potential losses and liabilities is crucial to achieving long-term growth. A modern customer protection solution should strike a balance between control and flexibility. Unfortunately, traditional protection programs often fail to adapt to an evolving market. Recognizing the need to switch to an approach more in line with your branding - ensuring your reputation and your offer meet the needs of your customers. This transition empowers you to align the program precisely with your unique requirements and preferences, resulting in elevated returns and a secure operational landscape. Making the transition can open doors to discovering untapped sources of revenue, AKA those stacks of cash we mentioned before. Switching offers a valuable chance to uncover and utilize all unexplored possibilities that are more aligned with your business goals.

Knowing When to Switch: Recognizing the Need for Change

Now is the time to take a closer look at your existing protection program or solution. Check your data - what's it telling you? Is your current configuration providing the optimal buying experience for your customers? What about your attachment rates - would they go up if you didn't have to redirect your customers to a third party?

We have found that many companies are missing a few zeros on their bottom line because they are stuck paying too much for a one size fits all solution - with a less than ideal user experience. But the impact goes beyond mere profit margins. When contemplating a switch, it's about aligning with a protection program partner that embodies the essence of innovation and versatility.

A strategic switch should encompass the promise of increased attachment rates, meaning more customers willingly opt for protection when it is intuitively embedded in their experience and when the protection makes sense for their overall transaction with your business. It’s really about having the opportunity to actively participate in the risk-sharing dynamic – a transformative model that breeds both confidence and cooperation. And let's not forget the potential to carve out a profit center within your protection program, creating a self-sustaining cycle that injects growth into your company. When opting for the right switch, you can strengthen your dedication to providing exceptional customer experiences that directly align with your customers preferences and expectations. You know what? Think of it as more than merely a switch; it’s truly a strategic move towards a brighter future that’s exponentially more prosperous.

Look at the results one company has seen in less than a year after switching from a traditional provider, uShip:

Overcoming Analysis Paralysis: The Right Mentality for Switching

The danger of remaining stagnant is real. Letting fear or competing priorities stunt your progress is not going to yield the business results you are after. It can be tough to break out of that mindset, especially, when nothing is “broken”. It’s easy to accept the status quo instead of adopting an agile mindset and prioritizing improvement. But now is the time to break free from indecision. Reap the rewards of making big moves that align with what your customers expect from their experience and grow your bottom line at the same time.

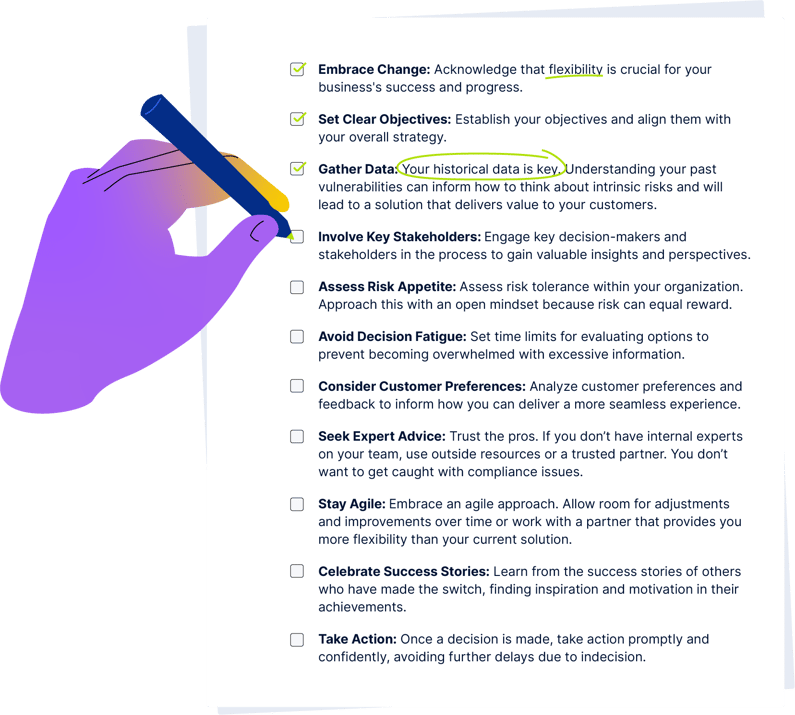

Strategies for overcoming analysis paralysis and making informed decisions

Balancing Program Design and Potential Gains: Being a Neutral Venue

If you are considering making a switch, staying focused on your end goals becomes paramount. Whether you are looking to increase conversion, generate profit, increase brand trust - or all three, staying laser focused on that goal will make the process of switching easier. There will be things you have to consider and decisions you'll need to make on the journey but keeping your goals in mind will help make those decisions easier. Does it contribute? Yes. Then move forward. There is always a delicate balance between seeing the gains you are looking for and streamlining operations. Lean on a partner to help you operationally, if the added work doesn't actually contribute towards your ultimate goals.

Solving Non-Traditional Challenges in a Traditional Industry

In the face of non-traditional challenges, it's clear that antiquated, conventional solutions just won't do. This is where Tint steps in. As an embedded protection expert, we make venturing into the realm of risk less daunting. Collaborating with a company founded by innovators, rather than adhering to the norms of traditional insurance offerings, opens the door to fresh perspectives and creative thinking. Here at Tint, this concept is our driving force. Infused with an entrepreneurial spirit and an unwavering readiness to take measured risks, our team excels in crafting tailored protection programs that not only resonate with businesses and end-users but also ensure a smoother journey into the world of risk management.

Our core values at Tint drive everything we do:

- Customers First: We design with you and your customers at the forefront of our minds. We recognize the significance of higher attachment rates, better reviews, and reduced claims in providing a stellar experience.

- Ambitious Outcomes: We're here to win together. Presenting a range of solutions today and continuously developing new offerings, we strive to create more avenues for revenue generation, ensuring your prosperity remains our priority.

- Compliant Agility: We remain vigilant in a landscape of evolving rules and regulations. Our commitment is to serve your customers while staying compliant, so you can trust our solutions without compromise.

- Constructive Candor: Honesty is our policy. Our protection pros are fearless in engaging in candid conversations, ensuring you're equipped with transparent insights for confident decision-making.

Our team of protection experts excels at utilizing cutting-edge technologies and data analytics to provide tailored coverage options and accurate risk assessments. This allows us to deliver personalized protection solutions that meet your needs and preferences. Our future-focused team understands the value of historical data when utilized correctly. By combining this valuable resource with our forward-thinking approach, we can quickly adapt to changing market dynamics and stay ahead of the curve. Our strategies are built to be adaptable. We're all about staying up-to-date with industry progress and making sure you have an edge in the marketplace. As fellow imaginative entrepreneurs, you understand. We founded our company with a passion for revamping how protection is delivered. By partnering with us, you'll join a group of like-minded individuals who value creativity and forward-thinking solutions. This partnership will give you a significant advantage in an ever-evolving marketplace.

Innovations and solutions to address these challenges

No doubt about it, the insurance industry has experienced a boom in insurtech solutions that address the old-fashioned problems of the industry with newfound efficiency and modernization. As technology advances, insurtech companies are seizing the opportunity to reshape how protection is delivered, offering tailor-made solutions across diverse industries. This is where Tint stands out.

Where traditional solutions only offer generic protection plans with limited flexibility, Tint creates programs that allow businesses to retain control over their protection offerings and pricing.

If you're currently providing a protection offer, you're likely aware that the user experience could be better. Is it time to steer away from the ease of the familiar and embrace a solution that boosts conversion rates and empowers you with greater profits? Instead of subjecting your customers to the complexity of navigating multiple platforms for coverage, why not provide them with a seamlessly embedded solution?

With Tint, you can trust that you are partnering with an insurtech pioneer dedicated to safeguarding your business and maximizing its growth potential in a rapidly changing landscape.

Funding and Monetizing Opportunities: Making the Most of the Opportunity

Switching protection partners requires careful funding considerations. One approach is to allocate part of the budget for the transition, showing commitment to customer experience and risk management. External funding, like strategic partnerships, can also secure necessary funds by showcasing increased profitability and satisfaction potential.

To seize this opportunity, prioritize revenue streams aligning with product uniqueness and customer preferences. Offer protection as an add-on, bundling it with existing products, or opt for dynamic pricing models. Personalization boosts attachment rates and satisfaction, maximizing the program's profitability. By strategizing and exploring funding, navigate the transition smoothly, unlocking profit potential.

In conclusion

Hey, if you want to make it big in business, you gotta be open to new ideas and roll with the punches. It's all about staying on your toes and being ready for whatever comes your way.

Maximize the potential of your protection program by addressing key questions, aligning it with your customers' needs, and boosting its profitability. For expert guidance, download our quick guide to ensure you're taking on the "Right" Risks and optimizing your protection program with valuable insights.

When you partner with Tint, switching protection providers becomes a game-changer for your business. We offer tailor-made solutions that safeguard you against industry risks, while elevating your brand and boosting customer loyalty. Say goodbye to analysis paralysis and seize opportunities for growth and success.

Don't let indecision hold you back. Unlock your business's full potential and customer satisfaction with Tint. As an insurtech leader, we're here to guide you towards the future with our Protection Pros, who are equipped to help you conquer any challenge. Ready to revolutionize your business? Let's work together to make it happen!