Companies today operate in an entirely different world than the one just a few months ago. Now, cash is more king than ever and, top of mind for so many businesses, is how to increase runways and build sustainable positions. Companies no longer have unlimited access to VC capital to pursue growth-only strategies, disregarding profitability until late in their lifecycle.

In this post, I cover why insurance should be a critical component for many companies, particularly marketplaces, in getting to and building upon profitability. These thoughts were recently shared at a virtual webinar as part of the Marketplace Risk Master Program. Free access to the webinar is available here. This post summarizes my remarks.

Boosting margins with insurance

Insurance has a dual impact on gross margins. First, it can increase the revenue when sold as part of the company’s offering. Second, it can decrease the costs of goods sold (COGS) when premiums paid to insurers are reduced. This characteristic makes it a powerful lever.

Online companies have data and access to risks that can be monetized with insurance products. They collect unique data about their users, their assets, and the transactional context. For example, an RV sharing company like Outdoorsy knows (1) who is the driver, (2) what vehicle is being rented, and (3) what the context is (e.g., the location, the time of the day, the weather, the duration, how the RV is driven, etc). This information is very useful for underwriting, and is something most insurers only dream of having access to.

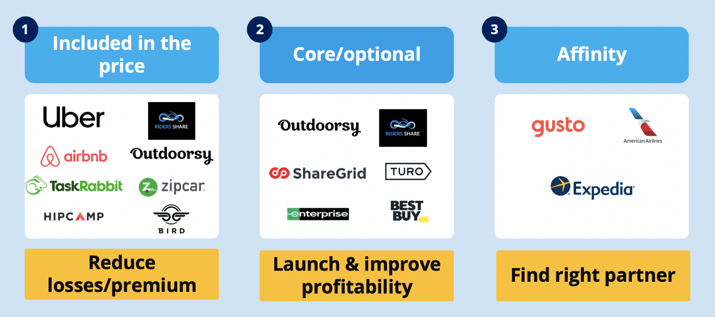

Some players in the ecosystem are already waking up to this opportunity. We’ve seen 3 main approaches to insurance:

- Included in the price: these companies buy coverage from insurers and include the cost as part of their services. For example, platforms such as Uber (ridesharing), Airbnb (homesharing), TaskRabbit (tasks), and Bird (scooters), offer insurance to their users and bundle this cost into the service fees they charge. The users don’t know how much the insurance is worth and may be upset if the company increases fees. In this case, the best strategy to improve margins is to try to reduce the insurance premiums paid by the company.

- Core/optional: some companies decide to sell insurance to enhance their core value proposition. Examples of companies in this group include vehicle sharing marketplaces such as Riders Share, Outdoorsy, Turo, car rental companies like Enterprise, and retailers that offer extended warranty options like Best Buy. These companies have control over the insurance products they offer and can experiment to maximize their profitability.

- Affinity: business can also use their touch points with customers to sell insurance products that are not related to their core offerings. This is called affinity in insurance lingo. Examples include payroll software providers selling health insurance like Gusto, auto dealers selling car insurance, and travel companies such as American Airlines and Experian selling travel insurance. For this group, the key is to find the right partner who will offer a ready-to-sell option that can be easily integrated into the customer journey.

Insurance optimization framework

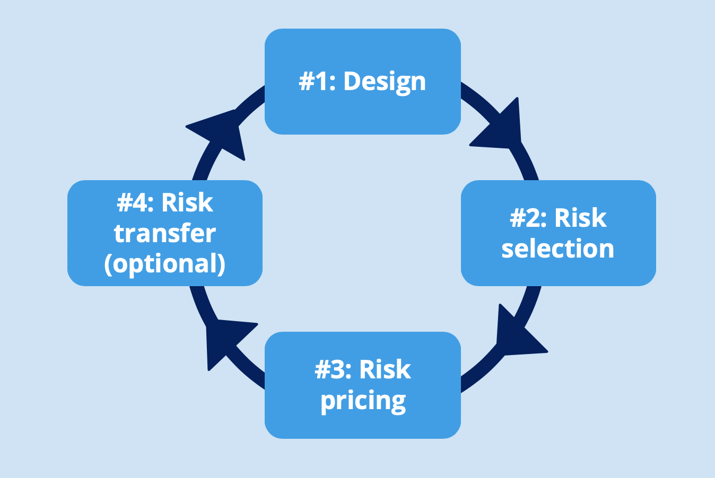

Designing, launching, and optimizing insurance products that are profitable and that improve the user experience is not easy. At Tint, we use the following framework when helping our clients:

Step #1: Design

First, the company needs to decide what it wants to offer to its users. Examples of questions to ask include:

- Do we offer different plans?

- What do we cover?

- What deductible? Limits?

- In which part of the UX do we offer insurance?

Let’s take a look at how Turo did it (detailed description of how Turo designed its protection plan). It decided to organize its protection plan in 3 categories to address different risk-taking preferences of its users: Minimum, Standard, and Premier. These plans all cover physical damage losses but have different limits, deductibles, and premiums. Turo also decided to have different parameters for these plans in different countries in order to incorporate local specificities.

The protection options are offered to the users during the check-out process and the cost is shown separately. Turo also lets users decline this protection.

Step #2: Risk Selection

What are the risks that the company accepts? In the insurance world, this is called underwriting criteria.

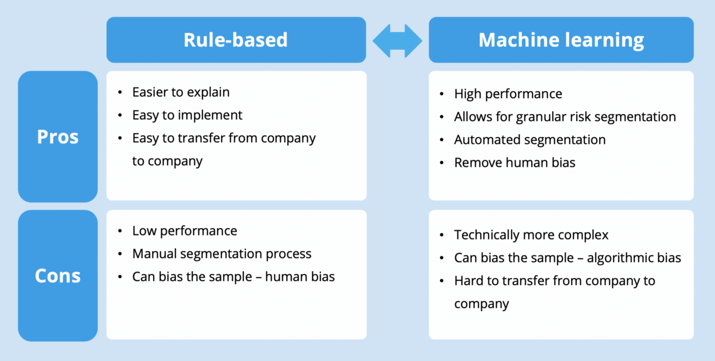

There are two ways of approaching this problem:

- Rules-based: the risk managers come up with simple rules for who the company is willing to accept as customers and insure. Examples here include a car-sharing marketplace that only accepts drivers older than 25 years old, a platform that requires the supplier to have at least 1 year of business track record, etc.

- Machine learning: the company uses data science techniques to extract patterns from its data that predict the risk of losses. In this case, managers don’t need to define the rules upfront, the model will use a combination of factors and find the profile of different risks. The output of this process can be synthesized into risk scores that inform the decision-makers.

Both are useful and have different pros and cons:

The most powerful risk selection processes will use a combination of both.

Step #3: Pricing

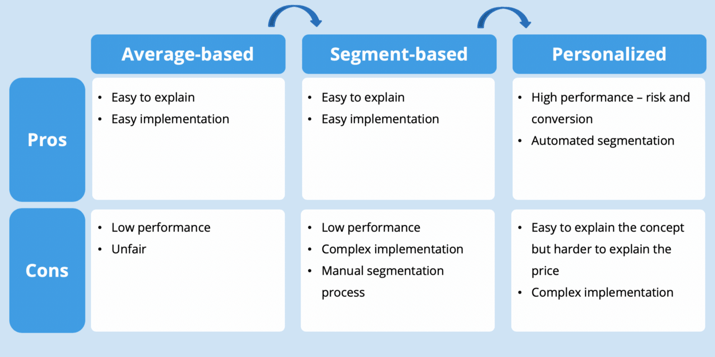

Now that the company has defined the criteria to filter out the risks that it doesn’t want to ensure, it’s time to set the price that the user will pay for the insurance policy. The best pricing schemes are risk-based and as granular as possible to ensure fairness for the users and sustainability for the company.

There are 3 basic ways to define the pricing:

- Average loss-based: the simplest possible one, it allocates the losses equality to all transactions.

- Segment-based: uses a few factors to separate the risks in small groups (e.g., young drivers in California) and allocate rates to them

- Personalized: uses many (20+) factors to create very granular risk segmentation that reflects the risk of each transaction

There are pros and cons for each of them:

Companies typically start with basic pricing when they don’t have a good understanding of their risk and don’t have enough data to segment it. Over time, they deploy sophisticated techniques to personalize the insurance offer and achieve higher profitability.

Step #4: Risk transfer

The last step is to figure out if the company wants to retain all or part of the risks or transfer it to an insurance company. Here are a few questions that can help the company decide:

- What are the legal requirements?

- How much cash do you have for loss reserves?

- Is insurance branding important?

- How much are insurers charging?

- How do we handle claims?

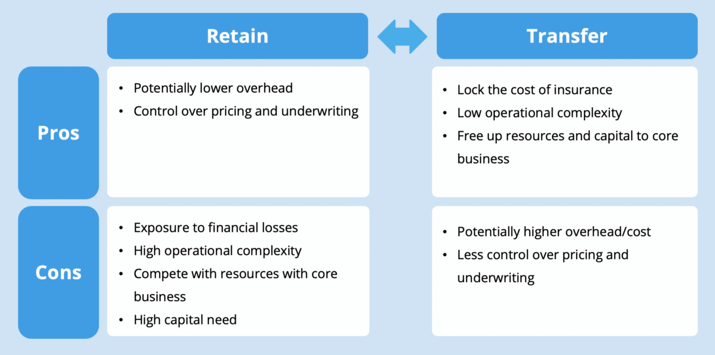

Here are the pros and cons of both options:

From our experience, companies transfer most or all of the risks in the early days when they don’t have enough capital to risk and data. As they scale, businesses start to internalize the risk functions and use tools like captives to reduce the overall cost.

Conclusion

Insurance is a critical lever to boost your company's margins while improving customer experience. It can help companies increase revenue through the sales of insurance products and reduce the costs of goods sold when premiums are reduced. A well-executed insurance strategy improves the quality of the service and provides valuable financial resources.

Achieving this is not easy, as the companies must execute each step in the framework described in this article well, which requires software and operational resources. Here at Tint, we focus on providing a seamless experience powered by our AI-first insurance infrastructure that helps companies design, launch, and optimize world-class protection programs. You come with your unique data and insights, we coordinate everything else.