Today, there is over $2 trillion in capital deployed in the insurance value chain to finance insurance Property and Casualty (P&C) risks. However, this model is incredibly inefficient. Approximately 40% of the money collected in premiums is spent on excessive layers (brokers/agents, insurers, reinsurance brokers, reinsurers, asset managers, etc) between risk and capital.

There is a better way. Insurance-linked securities (ILS) are an emerging asset class and streamline the risk transfer process by eliminating costs. They are offered directly to investors and thus strip away the operational inefficiencies of the current insurance value chain. Consumers spend less to get the protection they need while investors receive higher returns. That said, insurance-linked securities are extremely limited, available only for niche categories of insurance and to specific investors. There is an opportunity to expand both scope and reach, especially with technology.

Today’s technology, such as APIs and artificial intelligence models, allows the emergence of systems that were not possible before. Technology can power an efficient marketplace where insurance risks can be traded like stocks and bonds. Moreover, the risks inside a security can be tracked at the policy level, providing full transparency to investors and allowing them to price and exchange them in real-time.

In this article, I walk through the foundation and framework for the securitization of insurance risks and discuss how we can use such instruments to reinvent the re/insurance industries for the better.

The (very) Basics of Investing

While an in-depth review of investing theory is outside the scope of this article, I’m going to briefly mention some basic concepts relevant to the discussion.

In a simplified way, investing is providing money today with the goal of getting a return in the future. However, there is a risk the investment will result in a loss, instead of a gain. This leads to two key concepts: expected return, which is our best guess of how the asset will appreciate, and volatility, which is the risk of this investment and is measured by the standard deviation of the return. Both can be calculated based on the historical performance of the asset.

Intuitively, investors should try to find the maximum expected return with the lowest possible volatility. The Modern Portfolio Theory (MPT), which was introduced by Nobel Prize-winners Henry Markovitz and William Sharpe provides a framework that is widely used by investors. Their idea is that investment opportunities should not be considered alone and that investors can maximize their returns while minimizing risk if they combine multiple investments in a portfolio. It assumes that investors are risk-averse and prefer a less risky portfolio to a riskier one, assuming equal returns.

It introduces the Efficient frontier concept, the optimum combinations of return and risk that one portfolio can achieve. These efficient portfolios provide the maximum return for a given level of risk, so investors should find combinations that are as close to the frontier as possible.

Higher returns with less risk are possible because of diversification. By combining assets whose returns don't move together, the investor can diversify part of the volatility of the return while having the same return. This can be achieved if the securities have returns with a low correlation between them.

That's enough on the investment side. Let's move to insurance risks.

A Brief Introduction to Risk Pools

The risk-pooling concept is not new. Insurance, which was invented in ancient times and “professionalized” in London by Lloyds in the 16th century, has always used the pooling concept to spread risks and losses that would not be afforded by a single individual. The key insight they had was that by pooling a large number of risks, the variability of the losses in the pool decreases to the point that it can be predicted with a high level of confidence. This provides the expected loss of the risk pool, i.e. how much money will be paid in losses in aggregate.

Insurance companies charge a premium in exchange for paying for expected loss that is estimated by their actuarial teams. They also needed to factor in the expenses incurred in running the show (e.g., adjusting losses, fancy office buildings, high salaries, Super Bowl advertisements with mascots, etc). The P&C insurance companies in the US spend ~40% of their premiums, or $232 billion, to operate their businesses.

The goal is to collect more money than is paid in losses and expenses to achieve an underwriting profit. The simplified profitability equation of risk pool is:

- Underwriting profit = Premium - Expected loss - Expenses

The industry uses a metric called combined ratio to measure underwriting profitability, calculated as:

- Combined ratio = (Expected Loss + Expenses) / Premium

Values lower than one mean underwriting profit, while values higher than one show a loss.

Finally, we need to account for the capital available and the investment return. Premiums are received from customers upfront while losses are paid through the policy cycle so the money can be invested to generate returns. Risk pools need to have more capital available to pay losses than collected in premiums, to account for unexpected losses. The capital required, called surplus, can be calculated as multiple of the premium and represents the amount available for investment. The investment profit can be calculated as:

- Surplus = Premium x surplus ratio

Investment profit: Surplus x Investment yield

The insurance industry earns an average of 3% investment yield (Source NAIC).

We now have all the elements to model the profit of an insurance pool:

- Total profit = Underwriting profit + Investment profit

Profitability = Total profit / Surplus

Let's go through an example. Assume a risk pool that has 100,000 auto insurance policies with 1 year duration, with an average premium of $500, expected loss of $350 per policy, and $5M in expenses. The expected investment yield is 3%. The surplus ratio is 2. The metrics of this pool would be:

- Premium: 100,000 x $500 = $50,000,000

- Expected loss = 100,000 x $350 = $35,000,000

- Expenses = $5,000,000

- Underwriting Profit = $50,000,000 - $35,000,000 - $5,000,000 = $10,000,000

- Surplus: $50,000,000 x 2 = $100,000,000

- Investment profit: $100,000,000 x 3% = $3,000,000

- Total profit = $10,000,000 + $3,000,000 = $13,000,000

- Profitability = $13,000,000 / $100,000,000 = 13%

In summary, this risk pool would need $100 million in capital to return $13 million in profit, and earn a 13% return. This value is uncertain as the company doesn't know upfront how much it will pay in losses, therefore the volatility, or the standard deviation of the return, should also be considered.

The actual calculation can get more complicated when we account for losses that are paid in multiple years, reserving, etc. But this simplified computation shows how the cash flows and the return of a risk pool can be calculated.

Catastrophic Losses and Reinsurance

There is one important property of risk pools that requires attention: the exposure, i.e., the maximum that can be lost, is generally much higher than the premium. So there is a risk that the capital in the risk pool won't be enough to pay the losses if they are higher than anticipated.

In the example above, suppose the limit on the auto insurance policy offered to customers is $100,000, which means that the risk pool would pay up to this value in case of a claim. It collects $500 in premiums to accept this risk, so it can lose 200x of the value received if the maximum limit is exhausted, for instance, if the car is stolen or it's involved in an accident that causes a total loss. It gets worse as policies can have high losses at the same time in situations such as earthquakes and hurricanes.

Reinsurance, an adjacent industry, was created to help alleviate this issue. They insure the insurers against these improbable but high severity losses by spreading these risks across uncorrelated correlated pools, such as from different parts of the world or types of risks.

The cash flows and profitability of reinsurance contracts could also be modeled to predict their profitability and expected loss. The calculation is a bit different than what was presented above, so I'm going to leave them for another article.

Insurance Risks as Investments

As shown above, risk pools provide cash flows that can be estimated, which make them great candidates for securitization. The investment theories described above are widely applied to securities like stocks and bonds, but people don’t tend to think about them when considering insurance risks. This comes from the fact that a single insurance policy is normally associated with a loss, or a pure risk, which doesn’t provide profit potential. However, insurers who aggregate the risks and charge the premium can make a profit.

As explained above, investments are valued based on expected return and volatility (risk). This logic also applies to risk pools, where:

Expected return = ProfitabilityVolatility = Standard deviation of Expected return

In the example above, a security containing the cash flows of the risk pool would have an Expected return of 13%. The volatility could be calculated based on the standard deviation expected return of past years for similar risk pools (e.g., auto insurance risks in the same location).

The price of this instrument can be calculated similarly to how other assets are priced: the value of the expected cash flows discounted by the required rate of return.

The principal, or the capital invested in the security, may be insufficient to cover severe losses, which created an opportunity for other securities that deal with the excess exposure and play the same role that reinsurance plays today.

Application For Investment Portfolios

Insurance risks have a very low correlation to the market and provide diversification benefits. We covered how to calculate the expected return and volatility of insurance-linked securities (ILS). Now, let's quantify the diversification benefits and discuss the attractiveness to investors.

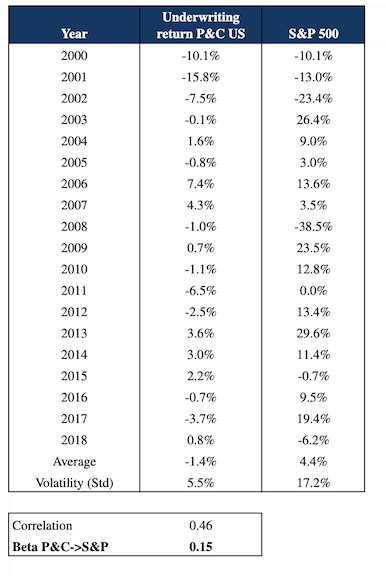

The sensitivity of the underwriting profit of US P&C insurance and the market (S&P 500), as measured by correlation and beta, are 0.45 and 0.15, respectively, as shown in the table below:

For comparison, the beta between different industries and the market is 1.12 (Source: NYU).

The low beta of insurance risks translates into lower expected returns from investors. Assuming the current 2% yields of the risk-free investment (10-year US T-Bills, source: US Dept of the Treasure) and 8% average return of S&P 500 in the last 17 years, the expected return for a typical P&C ILS would be 2.89%.

As can be seen, this is a cheap source of capital that should be widely deployed into risk pools that provide cost-effective insurance to companies and individuals.

The Insurance-Linked Security (ILS) Revolution

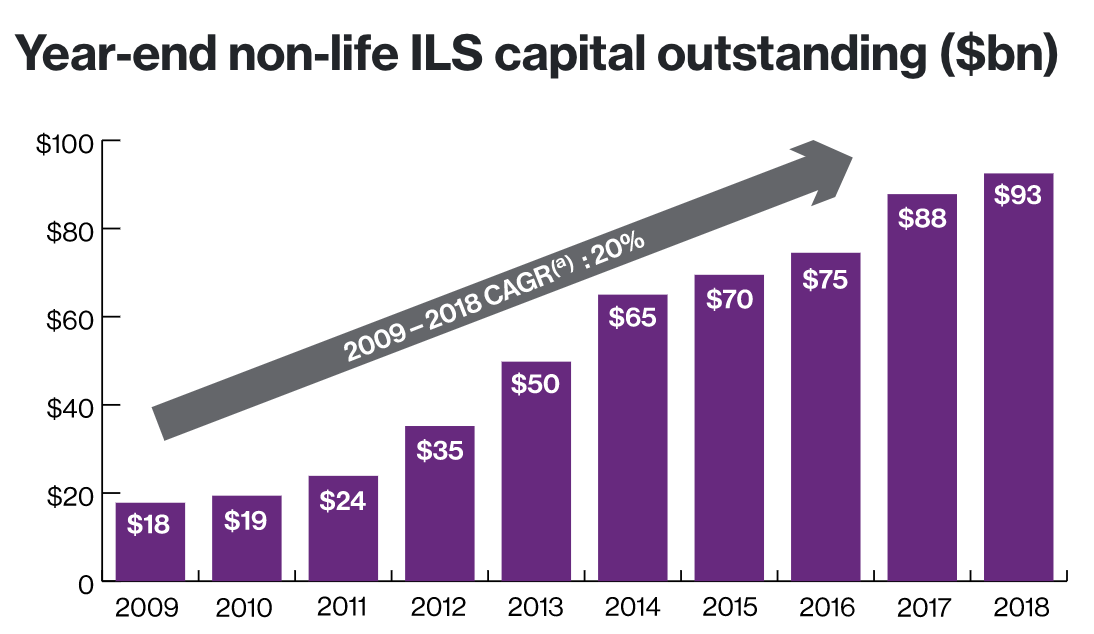

The revolution has already started. A new asset class called insurance-linked securities (ILS), which ties returns to insurance risks, is nascent but growing rapidly. According to the Willis RE ILS Market Update, there is almost $100 billion of capital deployed in ILSs, a growth of 20% per year since 2009:

This value is still less than 5% of the ~$2 trillion dollars currently sitting on the balance sheets of insurance and reinsurance companies, which shows how large the potential is. Moreover, most of the capital is allocated in catastrophe bonds, or cat bonds. You can find a great database of ILSs outstanding in the Artemis Deal Directory.

But this new market still needs to overcome a few challenges. There are some asset managers that offer these securities, but they are normally restricted to institutional investors that write $1M+ checks. Additionally, these risks are currently traded behind closed doors, with little transparency and liquidity. Finally, the costs to issue ILSs are still very high as they require legal structures (e.g., special purpose vehicles in Bermuda) that are expensive to create and maintain. In this case, only very large risk pools ($50M+) can be financed in a viable way.

We need to start applying this structure to any P&C insurance risk, such as personal auto, home, carsharing, car rental, travel, drone, etc. All we need are the right tools in place. Enter technology.

Technology and ILS: A Marriage Made in Heaven

Technology will bring ILSs to new heights by allowing individuals and companies who need protection to connect directly with investors, creating an efficient value chain for insurance. It will convert the current process from analog to digital.

With technology, insurance risks can be modeled at the policy level, as shown in this article, so investors can have visibility of what is inside the ILS purchased. The expected return can be tracked in real-time so pricing can be adjusted. Differences in risk tolerance and views on the return will foster trade and provide liquidity.

Such a marketplace will replace insurers in risk acquisition as policies will be offered at lower premiums than what is possible today because of: a) lower cost of capital due to expected returns from investors; b) lower expense ratios due to the elimination of legacy inefficiencies. The incumbents can still play an important role by providing the operations required to service these policies. There need remains to adjust claims and provide regulatory and customer support.

Unfortunately, insurers are threatened by this trend and will fight back to try to maintain a risk exchange as opaque as possible. On the surface, they will continue to talk about modernizing and embracing innovation. Lloyds of London themselves has announced the Future of Lloyds plan in which they promise to use technology to cut costs and create a more efficient marketplace. But the reality is that incumbents don’t have incentives to change the industry structure that they worked so hard to build.

Startups should rise to the occasion and pave this road. Their teams are better equipped to build the different pieces of this ecosystem to achieve efficiency, transparency, liquidity, and solvency.

Tomorrow’s risk marketplace will look very different from what they look like today.

Conclusion & Next Steps

Insurance risks are great investment opportunities due to returns that are not correlated with the market. This provides critical diversification to investors and could provide additional returns with very little volatility.

The growing insurance-linked security (ILS) market is consolidating as an alternative to the traditional re/insurance value chain. Technology will unleash this potential and create a marketplace where risk and capital will meet directly in a much more efficient way. There is still a lot of work to be done before this becomes a reality.

The next step is to build an MVP to demonstrate that: a) customers are looking for insurance policies at a lower premium that is lower than offered by insurers; b) operating expenses can be lower than the current 40%; c) these risks pools can provide an attractive return to investors.

I hope that this article starts a conversation and helps create a community of entrepreneurs and doers who will shape the future of ILS and insurance. We’re looking for people who are as excited as we are about building this future, so please feel free to reach out to speak to Tint's Protection Pro's to get caught up on everything in the industry and what Tint is bringing to the table.