Companies are constantly under pressure to up their game. If you're losing sleep over ways to streamline operations and boost conversions, an embedded protection solution may be the answer you've been overlooking. It's the most effective way to achieve both goals and increase your profits. Risk management and protection programs are seen as necessary expenses. But thanks to new technology and some industry know-how, these programs could actually increase profits. It's time to rethink and recognize that there's a lucrative opportunity here - one that can both streamline operations and provide more value to your customers.

Let's explore the strategic shift from viewing protection as a product that you purchase, to a feature that you embed in your platform. Emerging technologies are leveraging intuitive platforms, data-driven insights, and services led by teams of protection pros, to make your customers happy. How? With protection solutions that factor in your intrinsic risks, providing your customers an experience that feels natural - and providing your team the control and flexibility that traditional providers can’t.

The Challenge of Traditional Protection Programs

So you started your protection program with a traditional provider. It makes sense; to tell you the truth; that's how most businesses get their start in protection. But here's the thing - these conventional insurance companies aren't keeping up with what you and your customers really need. They sell you on a generic plan with limited flexibility, fraught with broker fees and commissions that only apply to them with a clunky claims process that causes your customer to have a negative experience that they are likely to take to a review site about your company. The truth is these old-school providers don't generate any revenue really, maybe a measly referral-type fee, while causing more problems than they are solving. They just weren't built to innovate.- Generic plans: We get it. One size fits all coverage might work for some companies at the beginning. However, consumers nowadays require protection that caters to their individual needs and risks. Standard protection plans often fall short, leaving gaps in coverage and causing frustration.

- Additional fees: When you opt for a generic protection plan, you're not just paying for coverage. You're often hit with a barrage of additional fees that chip away at your budget. These fees commonly contribute to covering marketing costs and other overhead rather than enhancing the quality of your coverage.

- Clunky claims process: There is something to be said for letting a third-party handle your claims. It has its place and time - some customers prefer to allow a third party to handle claims, but what about when you have no say in how your customers are treated? Those customers will still associate your brand with a poor experience - and you have no control.

Let's think big picture. You and your business have options. First, we'll explore some of the improvements that are taking place in risk management and protection programming.

AI-driven Innovation

In the fast-evolving landscape of protection programs, the game-changer you've been waiting for is AI-driven innovation. Imagine a protection program that's not just a headache, but rather a seamless, user-centric experience. The underwriting and Assurance Backed by Insurance (ABBI) program offers a risk-free and supremely flexible solution to launch new programs.

With AI at the helm, protection platforms revolutionize how your program operates. It delves deep into past claims and credit scores, leveraging comprehensive data and insights to craft policies that aren't one-size-fits-all. This means more accurate pricing tailored to your unique circumstances. And that's not all – AI's fraud detection prowess ensures your protection program is safeguarded against foul play, streamlining the entire process.

Gone are the days of old-fashioned, generic protection plans that frustrate you and your customers. Modernization brings a breath of fresh air to the industry, ensuring that your protection program becomes a beacon of efficiency and customer satisfaction. Say goodbye to the nightmare of traditional claims processes – AI and insurtechs are here to transform the game. It's time to step into a new era of protection, one defined by precision, flexibility, and customer-centricity.

Predictive Risk Management

Did you know that the volume of transactional data you already possess is a powerful asset in your arsenal? With predictive risk management, you can leverage your historical data to redefine the underwriting experience, making it incredibly efficient. Your data isn't just data; it's a tool that empowers us to offer you a protection program that evolves as your business grows.

AI-driven insights gleaned from your historical data enable us to provide the most intelligent pricing and risk analysis. These insights are the driving force behind a protection program that doesn't just react but anticipates risks. By identifying subtle patterns that might be difficult for humans to recognize, you can enjoy proactive risk mitigation that goes beyond the conventional.

The ability to access vast amounts of data isn't just about data—it's about making your protection program more than a static safeguard. It's about embracing an agile and dynamic program fine-tuned to your needs. Moreover, AI has the potential to simplify the process of risk management by automating monotonous tasks and minimizing the possibility of human errors. The utilization of AI can enable risk managers to make more knowledgeable decisions and establish a more secure future.

From Cost Centers to Revenue Generators

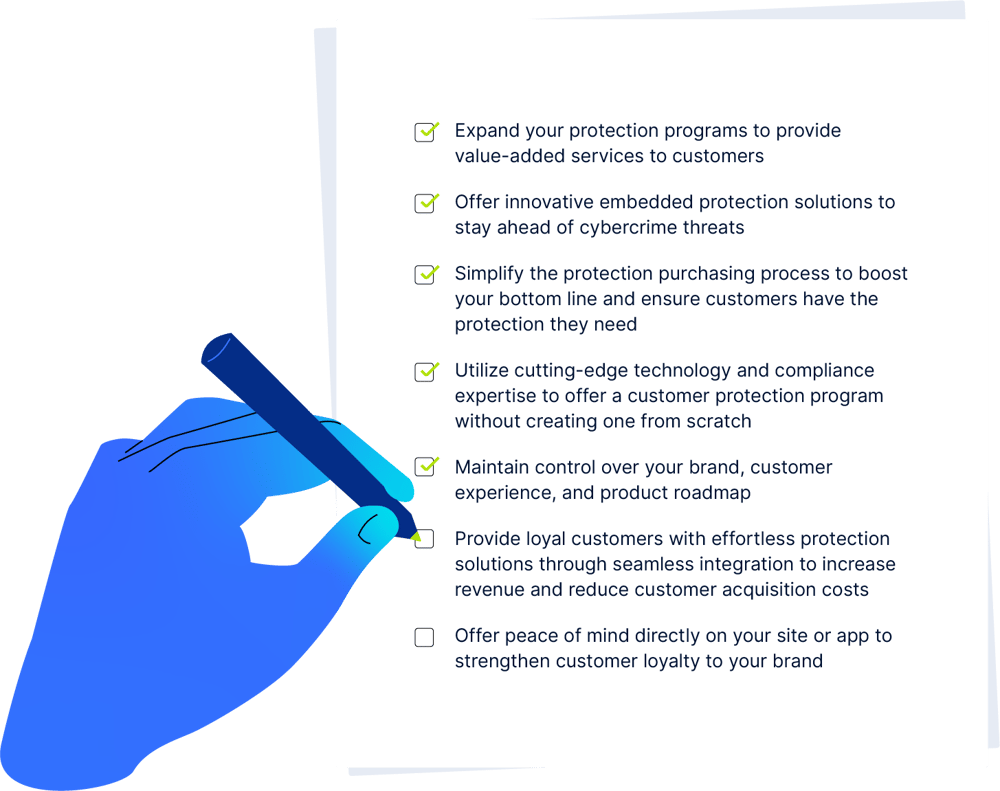

With a bit of strategic planning and a mindset change, here’s how your protection program can become a revenue generator.

So there you have it. With a little creativity and some decisive thinking, you can turn your protection programs from a cost center into a revenue generator. Who knew protection could be so profitable?

Tint-tastic Conclusion: Adding a Splash of Color to Protection

Here at Tint, we understand that each company has its own valuable data and knowledge that can be used to enhance protection solutions. Our job is to offer the technology and services needed to manage your entire protection solution, allowing you to concentrate on your core business.

Protect your customers with Assurance Backed By Insurance (ABBI). We provide access to the same risk transfer tools used by Fortune 500 companies, now available for startups like yours. Our ABBI program is designed so your organization can achieve maximum flexibility and growth while minimizing risk. Determine your preferred level of risk and watch your profits soar. As you continue to utilize your solution, take advantage of the transactional data to gain valuable insights that can enhance your overall performance. Tint's AI-first insurance infrastructure offers a seamless experience, empowering companies to take on the risk level that aligns with their goals, launch, and optimize world-class protection programs. Partner with Tint and capitalize on your unique data and insights to unlock the true potential of protection as a catalyst for growth and financial stability.